Services We Offer

Build Next-Gen FinTech Products

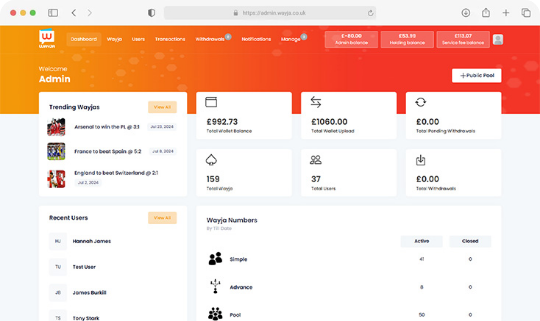

Digital Wallet App

Enable secure payments, top-ups, withdrawals, and P2P transfers with KYC support.

Crypto Wallet & Exchange

Store, send, receive, and swap cryptocurrencies with wallet keys and price tracking.

Online Lending Platform

Automate loan application, scoring, disbursal, and EMI tracking.

Investment Management App

Portfolio dashboard for mutual funds, SIPs, stocks, and retirement planning.

Buy Now Pay Later System

Deferred payment integration with merchant checkout and credit risk logic.

Payment Gateway Integration

Enable card, UPI, bank, and netbanking payments with PCI-DSS compliance.

RegTech Compliance Suite

KYC/AML screening, risk scoring, and audit logs for compliance-heavy apps.

Insurance Aggregator System

Compare policies, get quotes, and manage policies with claim tracking.

Blockchain Smart Contracts

Automate B2B agreements with verifiable and immutable smart contract logic.

Financial Reporting Tool

Generate P&L, ledger, tax, and balance reports from financial records.

Robo-Advisory Engine

Personalized investment suggestions using algorithms and user profiles.

Tokenized Asset Platform

Trade tokenized assets using blockchain infrastructure and compliance checks.

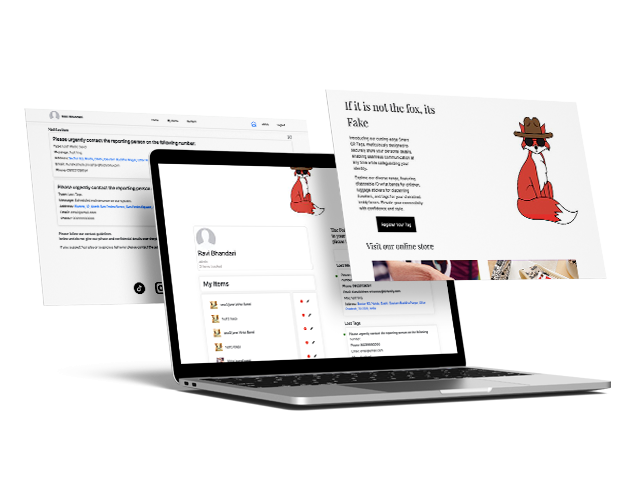

Custom dashboards for personal finance, lending, and real-time transactions with bank-grade encryption.

Crypto wallet integration, smart contract development, and Web3-enabled platforms for decentralized apps.

PCI-DSS Compliance

-

Secure handling of card payments with encrypted data pipelines and tokenized processing.

KYC/AML

-

Built-in identity verification, fraud monitoring, and risk-based user categorization.

Blockchain Protocols

-

Smart contract audits, Web3 wallet security, and gas optimization for Ethereum-based dApps.

Audit Trails & Reporting

-

Complete logs and automated financial reporting aligned with regulatory standards.

Frontend Development

- React.js

- HTML5

- CSS3

- SASS / SCSS

- JavaScript (ES6+)

- TypeScript

- Tailwind CSS

- Bootstrap

- Material UI

- Ant Design

- Redux

- Zustand

- Recoil

- Framer Motion

- Three.js

- Stencil.js

- .NET Framework MVC

- .NET Core MVC

Backend Development

- .NET Core

- .NET Framework

- Node.js

- Express.js

- Django

- Flask

- FastAPI

- Tornado

- Spring Boot

- Micronaut

- Quarkus

- Golang

- Laravel

- CodeIgniter

- Symfony

- WordPress

- Magento

- Drupal

- WebSockets

- RabbitMQ

- Kafka

- AWS Lambda

- Azure Functions

- Google Cloud Functions

- Tomcat

- WildFly

- IIS

- BigCommerce

- Shopify

- WooCommerce

Mobile Frameworks

- Swift

- SwiftUI

- Objective-C

- Kotlin

- Java

- Jetpack Compose

- React Native

- Flutter

- Xamarin

- KMM (Kotlin Multiplatform Mobile)

- Capacitor.js

- Cordova

AI

- TensorFlow

- PyTorch

- Keras

- Scikit-learn

- OpenAI GPT (ChatGPT, Codex)

- Google BERT

- spaCy

- NLTK

- OpenCV

- YOLO (You Only Look Once)

- Detectron2

- Google AI & TensorFlow Extended (TFX)

- AWS SageMaker

- IBM Watson AI

- Azure Cognitive Services

- Rasa

- Dialogflow

- BotPress

- Microsoft Bot Framework

- Jupyter Notebook

- Google Colab

- Streamlit (for AI-driven web apps)

- FastAPI (for AI API deployment)

Data Science

- Pandas

- R

- SQL

- NumPy

- SciPy

- Apache Hadoop

- Apache Spark

- Dask

- Google BigQuery

- Matplotlib

- Seaborn

- Plotly

- Tableau

- Apache Airflow

- Prefect

- DBT (Data Build Tool)

- FastAPI

- Flask

- MLflow

- Streamlit

Business Intelligence

- Tableau

- Power BI

- Looker

- Google Data Studio

- Snowflake

- AWS Redshift

- Google BigQuery

- Apache Nifi

- SAP BusinessObjects

- IBM Cognos Analytics

- Zoho Analytics

- Mode Analytics

- GoodData

- Google AutoML

- DataRobot

- Alteryx

DevOps & Cloud Service

- AWS

- Azure

- Docker

- Kubernetes

- Git

- Jenkins

- Grafana

- Azure IoT Hub

- Azure Stream Analytics

- Azure Storage

- Power BI

- Amazon Web Services (AWS)

- Google Cloud Platform (GCP)

- Microsoft Azure

- IBM Cloud

- DigitalOcean

- Linode

- AWS ELB (Elastic Load Balancer)

- Cloudflare

- AWS Lambda

- Google Cloud Functions

- Azure Functions

IOT

- ESP RainMaker

- Bluetooth Low Energy (BLE)

- MQTT

- Raspberry Pi

- Arduino

- ESP32

- AWS IoT Core

- Google Cloud IoT

- Azure IoT Hub

Blockchain

- Ethereum

- Solana

- Polygon (Matic)

- Brownie

- Truffle

- NFT & Token

- WalletConnect

- Trust Wallet

- Stripe Crypto & MoonPay

- The Graph (Decentralized Data Indexing)

- Alchemy (Blockchain API for Ethereum & Layer 2)

Domain Expertise. Delivered.

Solutions tailored to real business needs in this industry.

Partner with a trusted software engineering team that brings over a decade of cross-industry experience—combining domain understanding with full-cycle product development, AI-readiness, and scalable delivery models. Whether you are modernizing legacy systems or launching your next big idea, we build with speed, stability, and strategic insight.

-

Product Engineering That Understands Business

We don’t just write code—we align product decisions with your business model, goals, and go-to-market needs, delivering real-world value.

-

Full-Cycle Delivery, From Idea to Scale

From early discovery, prototyping, and MVPs to production-grade apps, DevOps, and managed support—we’ve got you covered end-to-end.

-

Agile Engagement Models

Work with us on fixed-scope projects, or extend your team with our on-demand, timezone-aligned developers and architects.

-

AI, IoT & Data-Ready Stack

We integrate emerging tech like AI/ML, IoT, and data analytics into practical business solutions—not just to innovate, but to deliver impact.

-

Clear Metrics, Transparent Progress

You’ll always know what’s being built, how it’s performing, and where it’s headed—with sprint demos, performance dashboards, and SLA-based reporting.

By integrating intelligent process automation (IPA), robotic process automation (RPA), and real-time data analytics, financial organizations can streamline their operations, reduce manual errors, and cut costs. AI-driven automation enhances decision-making, speeds up transaction processing, and improves overall operational efficiency, enabling financial institutions to deliver better services to their customers.

AI and machine learning analyze vast amounts of structured and unstructured data in real time, allowing financial institutions to make data-driven decisions. These technologies enhance credit scoring, detect fraud, assess risks, improve customer segmentation, and optimize investment portfolios. By leveraging predictive analytics, financial organizations can identify market trends, mitigate risks, and create more personalized financial products.

Yes, API-based solutions enable seamless integration with open banking platforms, fintech applications, and third-party financial services such as payment gateways, KYC verification systems, and fraud detection tools. These integrations allow financial institutions to enhance customer experiences, automate financial processes, and comply with industry regulations while ensuring secure data exchange between systems.

Modernizing core banking involves transitioning to cloud-native architectures, adopting microservices-based development, and implementing API-driven integrations. Legacy systems can be migrated to scalable, cloud-based solutions, while AI-powered automation streamlines processes like loan approvals, customer onboarding, and fraud detection. Open banking capabilities also allow banks to integrate third-party services and enhance security with advanced encryption and compliance measures.

AI-powered automation helps financial institutions streamline reconciliation processes by detecting discrepancies in transactions, integrating banking, ERP, and accounting platforms, and enabling real-time reconciliation. Machine learning algorithms analyze financial data to identify errors and suggest corrective actions. Automated exception handling and fraud detection enhance accuracy and compliance, while AI-generated audit trails provide transparent reporting for regulatory requirements.

Blockchain technology provides a decentralized and tamper-proof ledger system that enhances security in financial transactions. Each transaction is cryptographically encrypted and stored across a distributed network, making it resistant to fraud and cyberattacks. Smart contracts further automate compliance and reduce human intervention, ensuring transparency and trust in financial operations.

Yes, blockchain can be integrated with existing financial infrastructures through APIs and hybrid blockchain models. Financial institutions can implement blockchain solutions for payments, lending, identity verification, and fraud detection while maintaining interoperability with traditional banking systems. By leveraging blockchain’s security and transparency, institutions can enhance efficiency without completely overhauling their current operations.

The development timeline depends on the complexity of the solution, required integrations, and compliance requirements. A minimum viable product (MVP) can take three to six months, while a fully functional blockchain-based financial platform may take six months to a year. Factors such as smart contract development, API integrations, and regulatory compliance can also affect the overall timeline.