Generative AI in FinTech: Use Cases, Implementation & What It Costs

How is Generative AI transforming the financial sector, and what are the associated development costs? This question has moved to the forefront as banks, insurance companies, and fintech firms increasingly adopt AI to stay competitive and meet rising customer expectations. Generative AI isn’t just another trend—it’s a powerful shift in how financial services are delivered, optimized, and experienced.

Over the past few years, the financial industry has seen a surge in AI-driven innovation. Generative AI, specifically, is gaining traction for its ability to analyze large datasets, simulate outcomes, generate insights, and even create human-like interactions through chatbots and virtual assistants. It’s helping organizations streamline operations, reduce manual errors, and unlock new levels of personalization in customer service.

This blog takes a comprehensive look at the development costs associated with implementing Generative AI in finance. It will explore the technology’s growing influence, backed by recent data and reports, and walk through its benefits, various types, real-world use cases, must-have features, and the challenges companies face during integration.

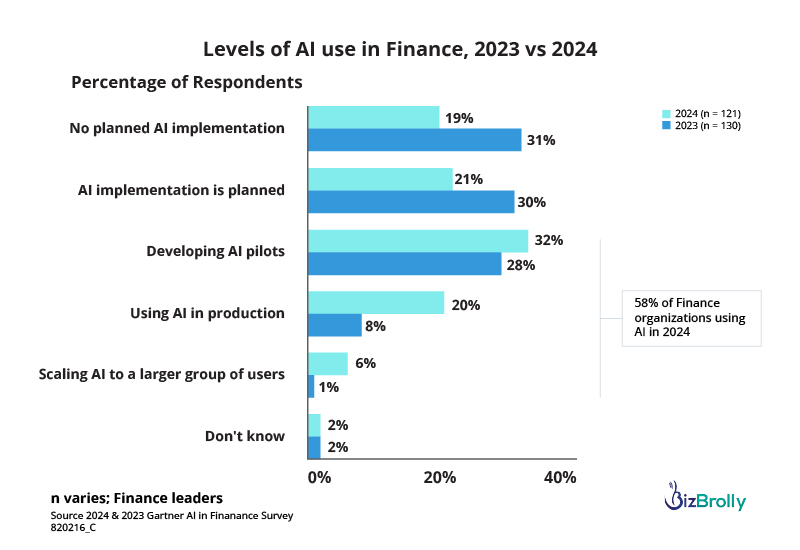

Generative AI is no longer a futuristic concept for the financial sector—it’s a present-day game-changer. Backing this trend, a Gartner survey published in September 2024 revealed that 58% of finance functions have already adopted some form of AI. This is a sharp increase from 37% just a year prior, highlighting how rapidly financial institutions are integrating AI technologies into their daily operations.

McKinsey & Company echoes this momentum in their recent insights on Generative AI in banking, stating that up to 70% of banking-related tasks could be automated with GenAI. From customer service and marketing personalization to fraud detection and regulatory compliance, AI is becoming central to operational workflows—driving both cost efficiency and improved customer experiences.

Additionally, a Research and Markets report forecasts that banks’ global spending on Generative AI will skyrocket from $5.6 billion in 2024 to a whopping $85.7 billion by 2030. These figures aren’t just impressive—they’re indicative of an industry-wide transformation, where AI becomes a strategic necessity rather than a luxury.

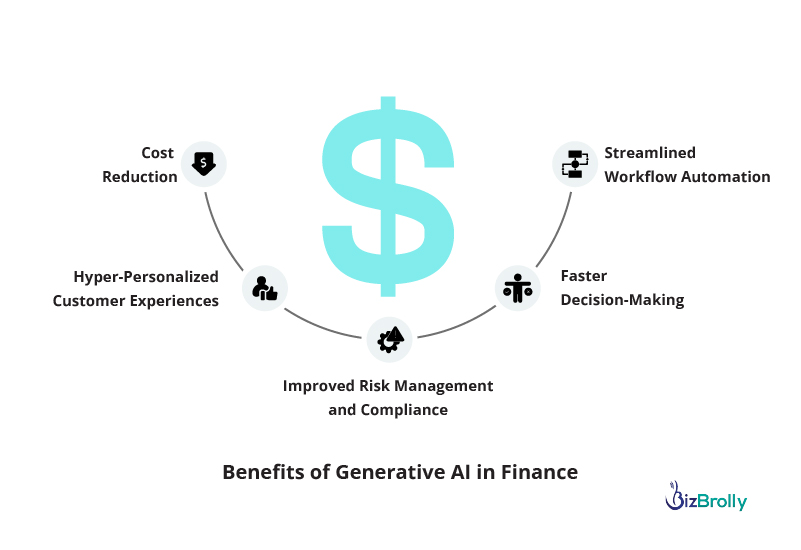

Generative AI is more than just a buzzword—it’s reshaping the financial services landscape. From automating routine tasks to enhancing customer interactions, its impact is profound. Institutions are seeing both strategic and measurable improvements. Let’s check out the benefits of Generative AI in Fintech:

One of the biggest advantages of integrating GenAI into financial systems is its ability to significantly reduce operational costs. By automating processes like document processing, report generation, and customer query handling, financial institutions can reallocate human resources to higher-value tasks. According to McKinsey, banks can potentially cut costs by up to 20% using GenAI-driven automation.

Generative AI can analyze customer data in real time and craft tailored messages, financial advice, or product recommendations. Whether it’s creating a custom investment portfolio or helping clients with budgeting tools, the customer experience becomes far more relevant and engaging—boosting satisfaction and retention.

With the ability to process and synthesize large datasets, GenAI can quickly generate insights that support smarter, faster decisions. Whether it’s assessing loan eligibility or detecting anomalies in real-time transactions, GenAI enhances agility without sacrificing accuracy.

Regulatory compliance is a huge challenge in finance. GenAI can assist by continuously monitoring transactions and automatically generating compliance reports. It can also help identify patterns of fraud or unusual behavior, providing early warnings that save both money and reputation.

From underwriting and claims processing to internal auditing, GenAI helps build more efficient systems. It integrates across departments to ensure consistency, reduce duplication of effort, and increase overall productivity.

The world of Generative AI is built on different model architectures, each tailored to specific tasks. In finance, choosing the right type of model depends on the use case—whether it’s generating content, predicting outcomes, or detecting anomalies.

LLMs like GPT (by OpenAI), Claude (by Anthropic), or Google’s Gemini are trained on massive datasets and excel in natural language understanding and generation. In finance, they are widely used for automating customer support, drafting financial reports, and assisting with compliance documentation. These models can also explain complex financial products in a simplified manner for retail investors.

Transformer architectures, the backbone of many GenAI systems, are excellent at processing sequential data—making them ideal for financial forecasting, risk scoring, and real-time fraud detection. These models can analyze time-series data such as stock prices, interest rates, and credit history to produce reliable insights.

VAEs are used to generate synthetic data, which is highly valuable in training other models while maintaining compliance with data privacy regulations. Banks use them to test models or simulate stress scenarios without compromising sensitive customer information.

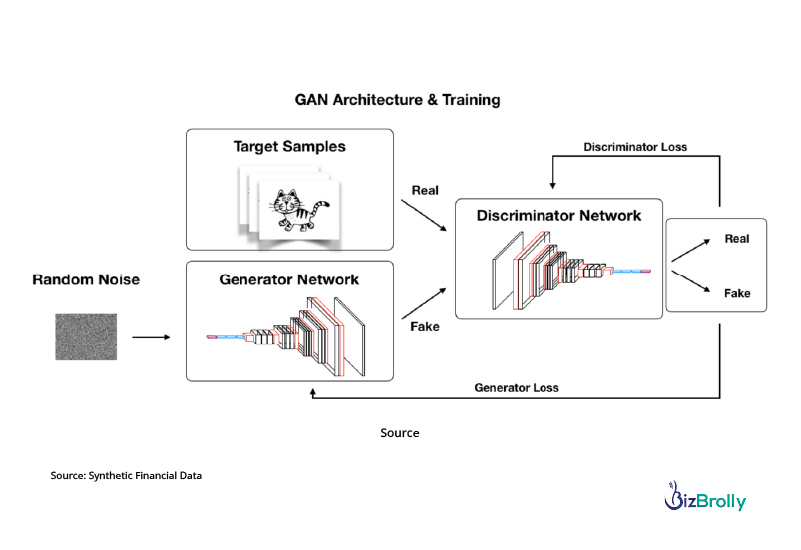

GANs work through a system of two competing networks—a generator and a discriminator. In finance, GANs are often used for generating synthetic transaction data, enhancing fraud detection systems, and creating realistic scenarios for risk management simulations.

These are capable of processing and generating outputs from multiple data types—text, images, charts, or audio. In finance, they are being explored for automated visual report generation, conversational dashboards, and even voice-based virtual advisors.

Each of these models has a specific role to play in reshaping modern finance, offering more intelligent, scalable, and compliant solutions.

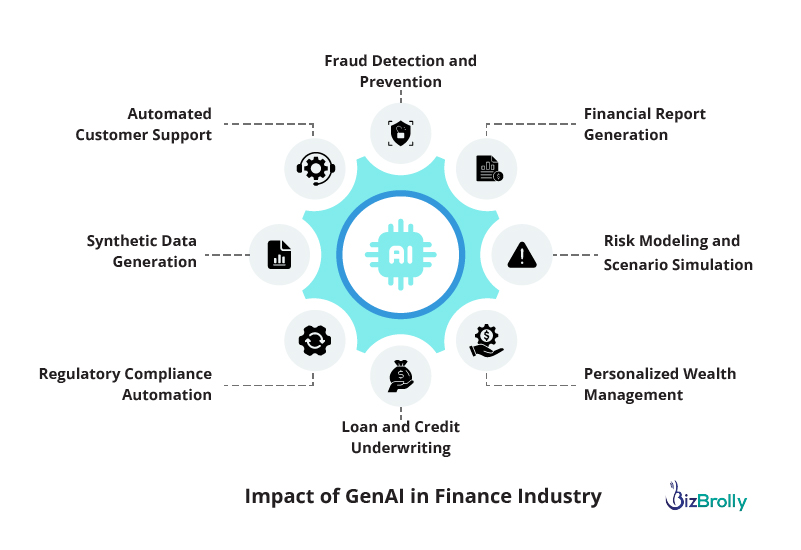

Generative AI has moved far beyond experimental stages in finance—it’s actively reshaping the way institutions serve customers, manage risks, and make decisions. Here are some of the most impactful real-world use cases:

AI-powered chatbots and virtual assistants built on LLMs like GPT can handle everything from answering FAQs to resolving account issues. These bots don’t just follow scripts—they understand context, detect sentiment, and offer tailored responses, reducing customer service wait times and enhancing satisfaction.

Generative AI models can draft complex financial reports, investment memos, and earnings summaries in a fraction of the time it would take a human analyst. This allows finance teams to spend more time interpreting insights and less on formatting and manual data entry.

By analyzing historical transaction patterns, GenAI can identify unusual activities in real time and flag potential fraud. Unlike rule-based systems, GenAI adapts to new fraud strategies quickly—making it a dynamic tool in fighting financial crime.

Generative AI can simulate multiple market conditions and credit scenarios, helping banks better assess potential outcomes. This is particularly useful for stress testing, forecasting, and developing risk mitigation strategies.

AI-driven robo-advisors can analyze individual customer profiles, financial goals, and market trends to generate personalized investment advice. Some systems even adjust portfolios in real-time based on changes in the market or user preferences.

GenAI models can analyze a borrower’s financial history, behavior, and even unstructured data like social media (in specific markets) to offer a more accurate and holistic credit score. This speeds up the underwriting process and improves financial inclusion.

Compliance teams use GenAI to generate reports, interpret evolving regulations, and monitor transactions for compliance breaches. Natural language understanding allows these tools to scan through legal documents, flag risks, and summarize key regulatory points.

For institutions bound by data privacy regulations, GenAI can generate realistic but anonymized datasets. These are invaluable for model training, testing, and R&D—without compromising sensitive information.

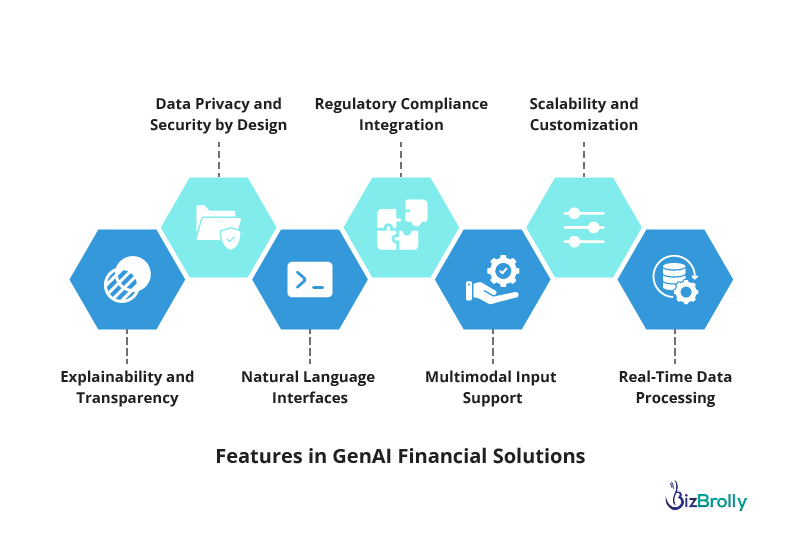

For financial institutions to fully leverage the power of Generative AI, the underlying solutions must be built with a solid set of features. These features ensure not just technical performance, but also security, compliance, and usability—key pillars of trust in the financial world.

Finance is a highly regulated industry, so GenAI systems must be built with robust encryption, role-based access controls, and secure data handling mechanisms. Whether it’s customer information or internal financial data, privacy should never be an afterthought.

Financial decisions often rely on real-time data. From analyzing live transactions to detecting fraud on the fly, GenAI tools must have real-time ingestion and processing capabilities. The faster the system, the more valuable the insights.

AI in finance can’t be a black box. Institutions must be able to explain how a model arrived at a certain output—especially in critical areas like credit scoring or fraud detection. Built-in explainability helps maintain trust with regulators and customers alike.

GenAI platforms should come preloaded or be easy to integrate with compliance frameworks. Whether it’s Basel III, GDPR, or local KYC/AML norms, the AI should support rule monitoring, automatic alerts, and audit-ready documentation generation.

The best GenAI systems in finance make complex data accessible through simple language. With natural language interfaces, users—from C-suite executives to customer service agents—can ask questions and get insights without needing to know SQL or code.

Modern finance isn’t just numbers—it’s contracts, emails, charts, and customer calls. GenAI platforms that support multimodal input (text, images, voice) can offer deeper analysis across more sources of information, providing a 360° view.

Whether you’re a startup fintech or a multinational bank, the AI solution should scale with your growth. It should also be customizable to meet unique workflows, risk models, or customer engagement strategies.

While the potential of Generative AI in finance is massive, getting it right isn’t always straightforward. From data compliance to cultural resistance, financial institutions often face roadblocks that can stall or derail implementation. Here’s a look at the most common challenges—and how to overcome them.

Finance operates under strict regulations like GDPR, CCPA, Basel III, and others. Handling sensitive data (like customer transactions or KYC info) raises red flags when introducing AI.

Implement privacy-preserving techniques such as data anonymization, federated learning, or synthetic data generation. Partnering with a vendor experienced in finance-specific compliance ensures that GenAI tools meet legal requirements without sacrificing innovation.

AI is only as good as the data it’s trained on. Many financial institutions still operate on fragmented legacy systems, leading to incomplete, inconsistent, or unstructured data.

Start with data unification. Build strong data governance frameworks and invest in pre-processing pipelines that clean, normalize, and label data accurately. Using GenAI to extract structured information from documents is also becoming increasingly common.

Not every finance team has AI engineers or data scientists who can deploy and maintain generative AI models.

Collaborate with AI development partners who specialize in fintech solutions. Low-code and no-code AI platforms are also emerging as useful tools, enabling non-technical users to deploy GenAI models with minimal friction.

In critical decisions like credit scoring or fraud detection, a “black-box” AI model with opaque outputs can be risky—and potentially unethical if it shows bias.

Use explainable AI (XAI) frameworks that break down how the model arrived at each decision. This not only increases trust with regulators and customers but also helps fine-tune the system for fairness and accuracy.

Employees may fear that AI will replace them, while leadership might hesitate due to unclear ROI or the complexity of implementation.

Start with pilot programs that clearly demonstrate value. Position GenAI as a tool that supports and amplifies human effort, not replaces it. Change management workshops and training programs can help smooth the transition.

Integrating Generative AI into your financial infrastructure isn’t a plug-and-play task—it requires careful planning, the right partnerships, and a phased approach. But when done right, it can transform your operations and customer experiences.

Here’s a step-by-step roadmap to help you get started:

Start with business goals, not technology. Are you looking to automate customer service? Generate reports? Detect fraud in real-time? Pick one or two high-impact use cases and map out the expected outcomes—reduced costs, better accuracy, improved customer engagement, etc.

Data is the foundation of any GenAI system. Audit your current data sources—structured and unstructured—and evaluate their quality, accessibility, and compliance readiness. You may need to invest in data cleaning, labeling, or integration with APIs to make them usable by AI models.

Select a model based on your use case. For example:

GenAI integration isn’t just an IT project—it’s a collaboration between data scientists, compliance officers, finance experts, and product owners. Make sure all stakeholders are involved from day one to align business goals and technical capabilities.

Start small. Create a PoC for one use case (e.g., a chatbot that answers FAQs or a model that generates financial reports). Test it with a limited user group, gather feedback, and refine.

Before full deployment, run the AI solution through risk assessment, compliance checks, and penetration testing. Integrate security layers—like role-based access, data encryption, and logging—especially when dealing with sensitive financial or customer data.

Once live, continuously monitor the model’s performance and accuracy. GenAI models can drift over time as data patterns evolve, so set up a retraining and feedback loop to keep them sharp and reliable.

After validating success with one use case, scale to other departments—compliance, marketing, lending, etc. Customize workflows and dashboards for each, creating a unified GenAI-powered ecosystem.

The finance sector is undergoing a significant transformation, and Generative AI is at the heart of it. From personalized customer experiences to intelligent risk modeling, GenAI is no longer a “nice-to-have”—it’s a strategic necessity.

But here’s the thing: successful GenAI adoption isn’t just about having the latest tools or chasing trends. It’s about smart integration, compliance alignment, and choosing the right partner who understands both the tech and the industry landscape.

That’s where BizBrolly comes in.

At BizBrolly, we specialize in building custom, scalable, and regulation-ready GenAI solutions tailored for the financial domain. Whether you’re looking to launch a smart virtual assistant, automate loan documentation, improve fraud detection, or reimagine customer service, we’ve got the tech stack and industry expertise to make it happen.

Here’s how we can help:

The future of finance isn’t just faster or cheaper—it’s smarter. And with BizBrolly by your side, you’re not just adapting to the AI revolution—you’re leading it.

Let’s build the future of finance together.

In the healthcare sector, safeguarding patient data is not just a regulatory req...

Explore more

In the evolving landscape of healthcare, the focus has steadily shifted towards ...

Explore more

D-23, Sector 63, Noida,

UP - 201307

141 Westgate Dr, Edison,

NJ - 08820

4 Black lion court, Mill road, Kent, UK – ME71HL

2207, 2220 Lakeshore Blvd W, Toronto ON- M8V0C1

94A Central Road, Jacanlee, Johannesburg 2194