Decentralized Finance Defi is making a transformation in conventional finance, breaking a relationship generally reliant upon a brought together biological system. Defi is presenting a better approach for rehearsing finance, predictable with the development of an advanced age where blockchain innovation is the foundation of a worldwide environment. Total Value Locked (TVL) is currently $172.71 billion and developing.

Defi patterns give probably the best chances for both advancement of innovation and the capacity to procure significant benefits. Some Defi patterns are more effective than others. Knowing how to perceive Defi drifts and expand the accessible chances will prompt extraordinary abundance for some.

Read More: HOW TO UPLOAD AN APP ON GOOGLE PLAY STORE?

Defi Explained

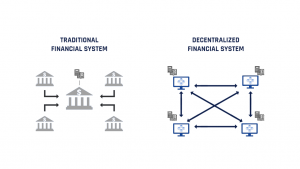

Defi presents the execution of monetary exchanges through decentralized applications from an incorporated body. Conventions utilizing Defi can work with exchanges without middle people like banks, state-run administrations, and heritage monetary foundations. Joint effort inside Defi markets is finished through shared, lessening the need for any facilitators.

What’s a Defi Trend?

Like the clothing labels, Defi Trends is the latest and famous advancement inside decentralized finance. DeFi’s prominence has detonated in the beyond eighteen months, speeding up additional after acquaintance with the public. Advancements, for example, presenting new getting and loaning conventions and DEX’s are instances of Defi patterns. The accomplishment of Defi and the resulting Defi patterns that follow an extensive commitment from clients and progressing advancement of the past innovation.

What Are The Most Recent Defi Trends?

A few improvements in Defi are demonstrating exceptionally unique naturally. In a quickly paced climate like Defi, being quick to perceive and exploit a Defi pattern is profoundly invaluable. As of late, liquidity mining, otherwise called Defi yield cultivating, was one of the most sweltering Defi patterns, prompting the ‘Defi Summer’ in 2020.

Decentralized Exchanges like Uniswap, Sushi, and Pancakeswap acquired a huge influx of clients of their administrations during this time, as the Defi pattern of yield cultivating detonated.

Top 3 Defi Patterns to Keep An Eye Out For In 2021-2023

Inheritance Financial Establishments Are Presenting Defi Items: Traditional Finance is currently completely mindful of DeFi’s latent capacity. A model is the dispatch of decentralized subordinate items. The current TVL of Defi subordinates is assessed at $3.35B worldwide, up from $132M in 2020. Customary monetary items, for example, choices exchanging is additionally turning into a hot Defi pattern for 2021 and then some.

Cross-Chain Technology: Ethereum is considered the home of Defi and the leader stage. Notwithstanding, DeFi’s innovation presents significant versatility issues, given the quick development of the Defi biological system. During high occasions of the clog and very fast development, the ETH network becomes blocked, causing practically unreasonably expensive high gas charges. With many ventures presenting cross-chain usefulness in their items, this issue is being tended to.

Adapting Blockchain Gaming: Gaming is tipped to turn into a critical Defi pattern by 2023. Defi developers are working diligently, expecting to take advantage of the capability of two billion gamers worldwide by adapting blockchain gaming. Rather than procedure on an incorporated server, the computer games work on a blockchain, permitting gamers to mine tokens during their gaming exercises. In-game adaptability empowers resource proprietors to acquire computerized returns on their resources. This pattern plans to catch a market with $159B available for use every year and is projected to become greater.

Will Defi Keep On Developing?

Indeed, Defi will keep on developing at a consistent rate within a reasonable time frame, as will the previously mentioned Defi patterns. Most obstructions at first restricting DeFi’s development keep on being tended to, preparing for a highly reasonable turn of events.